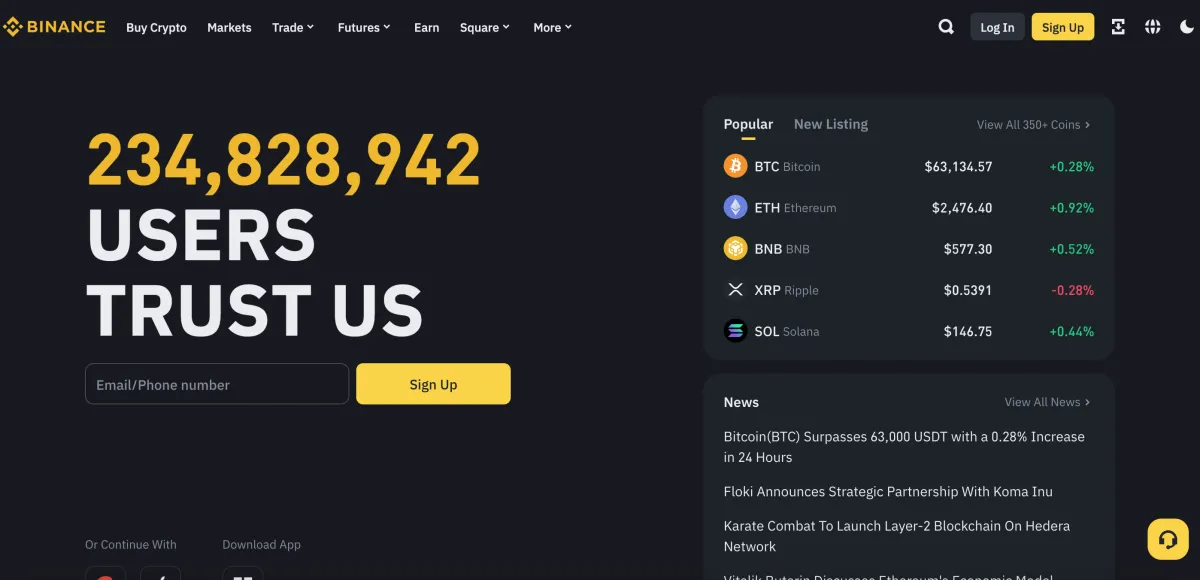

Binance was founded in 2017 by Changpeng Zhao (known as CZ) and has since become the most popular and technologically advanced cryptocurrency exchange in the world. You've probably heard of Binance at least once if you've ever been interested in cryptocurrency, and that's not surprising, as the exchange has over 270 million active users.

Like most popular modern exchanges, Binance is not just an exchange but a whole cryptocurrency ecosystem. It ranges from the classic exchange for trading cryptocurrency to lending and staking. This means you can not only trade cryptocurrency but also take advantage of many other features without leaving the Binance platform.

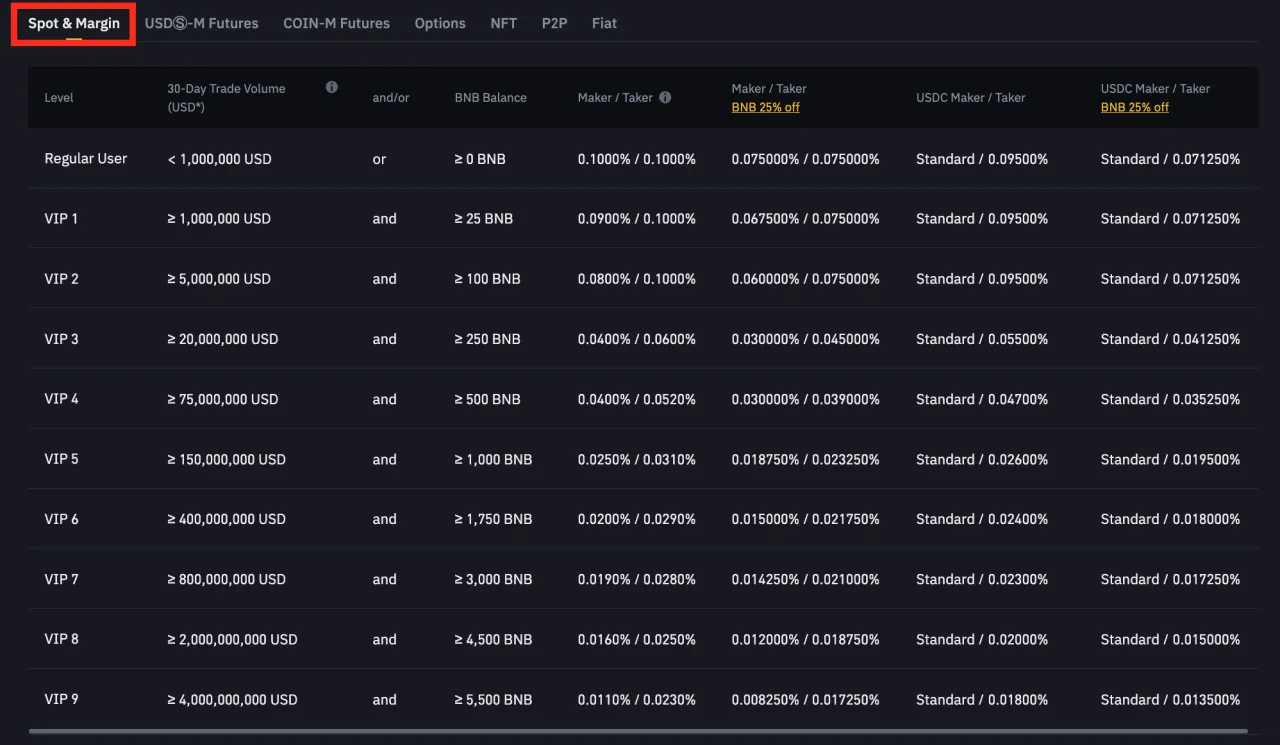

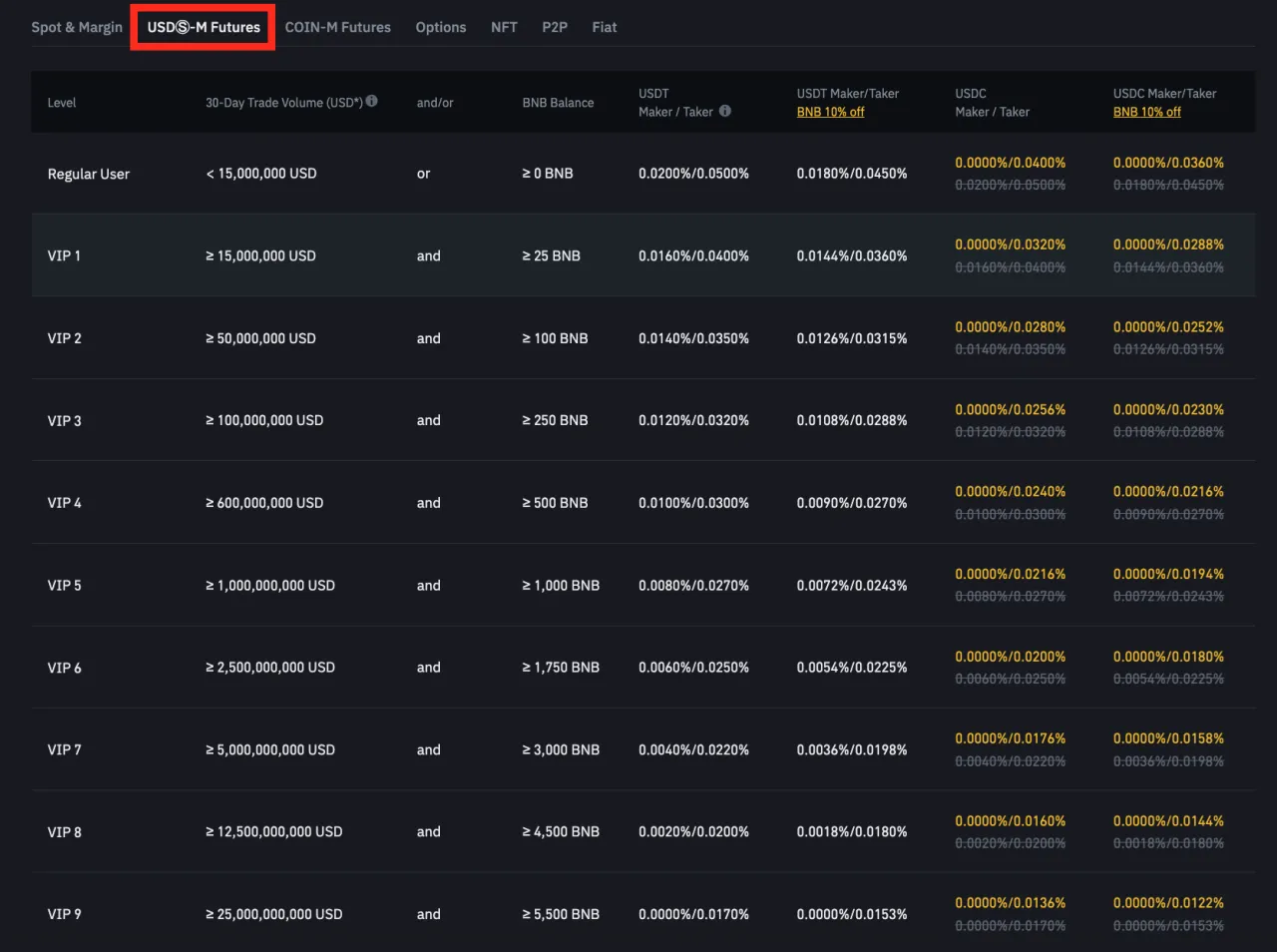

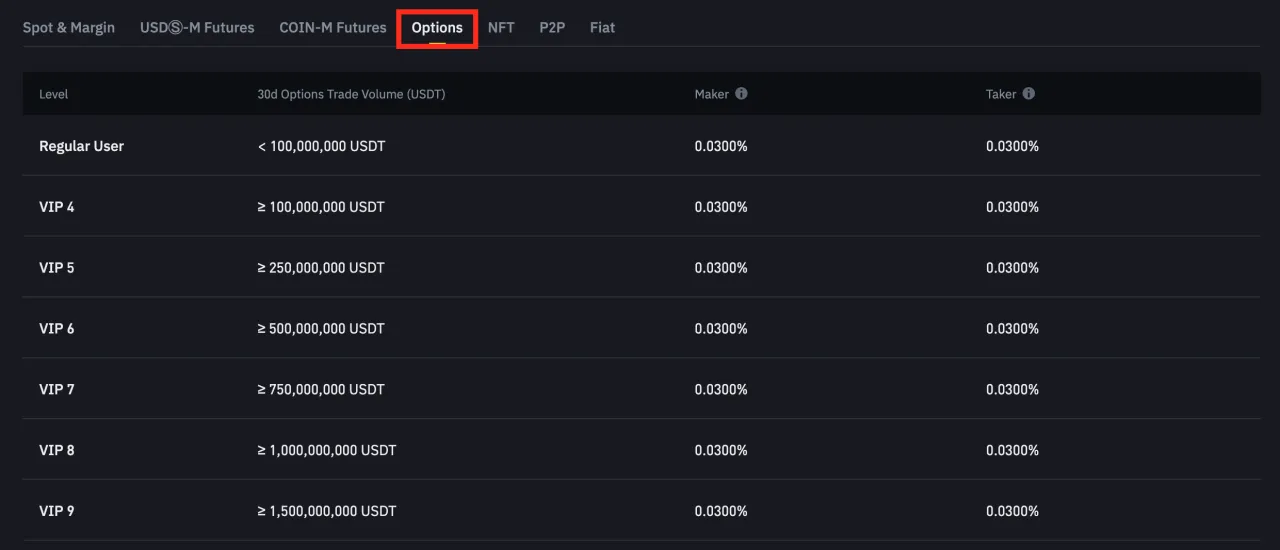

Fees

One of the reasons Binance has gained such popularity is its competitive and user-friendly trading fee structure:

• Spot: Maker – 0.1%, Taker – 0.1%

• Futures: Maker – 0.02%, Taker – 0.05%

• Options: Maker – 0.03%, Taker – 0.03%

Moreover, you can get a 25% discount on spot trading and a 10% discount on futures trading by paying with BNB (the native token of the Binance Smart Chain). You can also enjoy additional discounts for high trading volumes or by maintaining a BNB balance in your account.

Commissions for spot trading on Binance

Commissions for futures trading on Binance

Commissions for options trading on Binance

You can find more details about trading and deposit/withdrawal fees here.

You may be interested in: Rating of crypto exchanges in Australia 2026

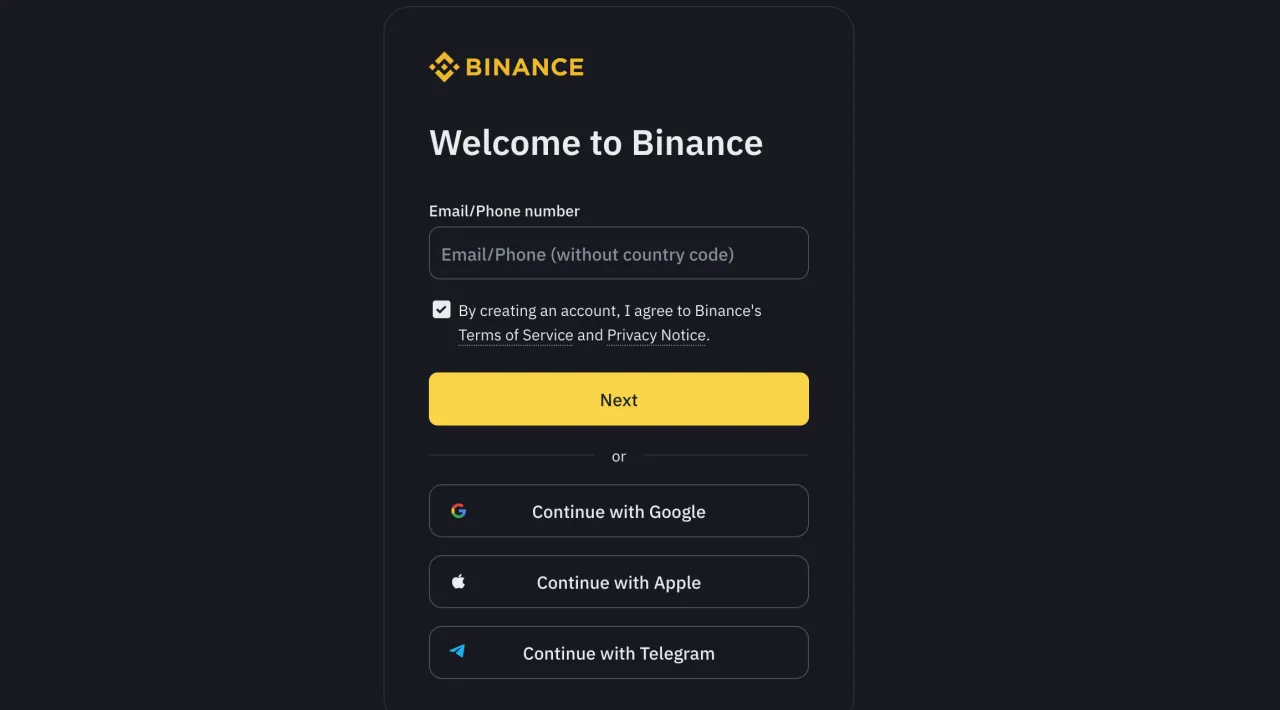

How to use Binance

Step 1: Registration

First, go to https://binance.com/ and start the registration process. The following registration methods are available:

- Using email

- Using a mobile number

- Using a Google account

- Using Apple

- Using Telegram

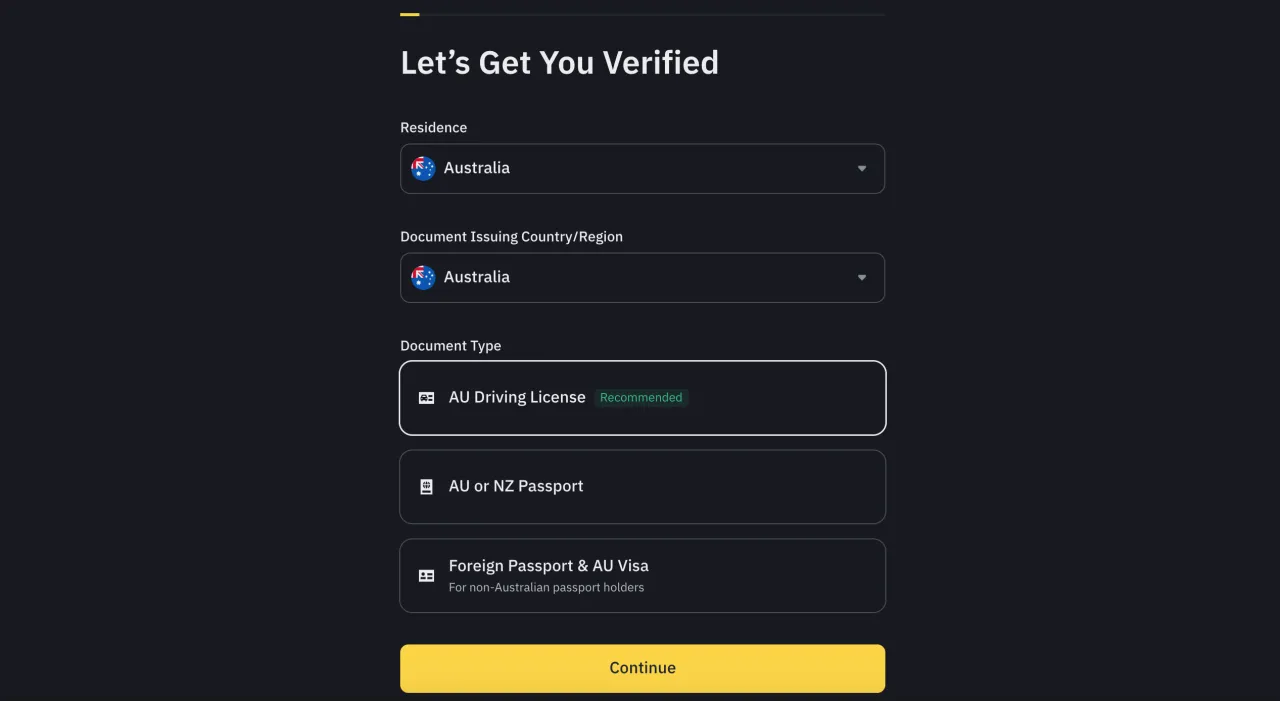

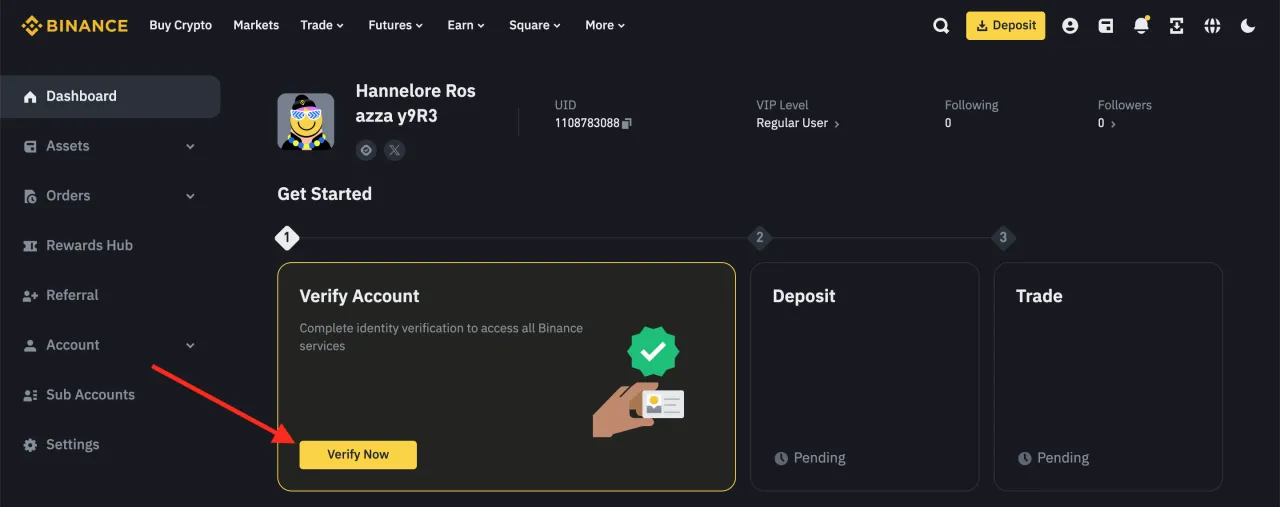

Step 2: Pass KYC

To use the Binance exchange, you need to complete the KYC (Know Your Customer) procedure to verify your identity. You can do this using your passport or driver’s license.

If, for some reason, you weren’t redirected to verification or skipped this step, you can complete it later from the main page of your personal account.

Verification is very fast and usually takes no more than 5 minutes. To pass verification on the first try, take high-quality photos and follow Binance’s instructions.

Step 3: Fund your balance

To buy or sell cryptocurrency, you need to fund your account. There are two options:

-

With fiat currency (depending on your region, this can be a direct deposit in local currency or via P2P)

-

With cryptocurrency (this is the most popular way to deposit, especially considering the rapid development of stablecoins in the crypto world)

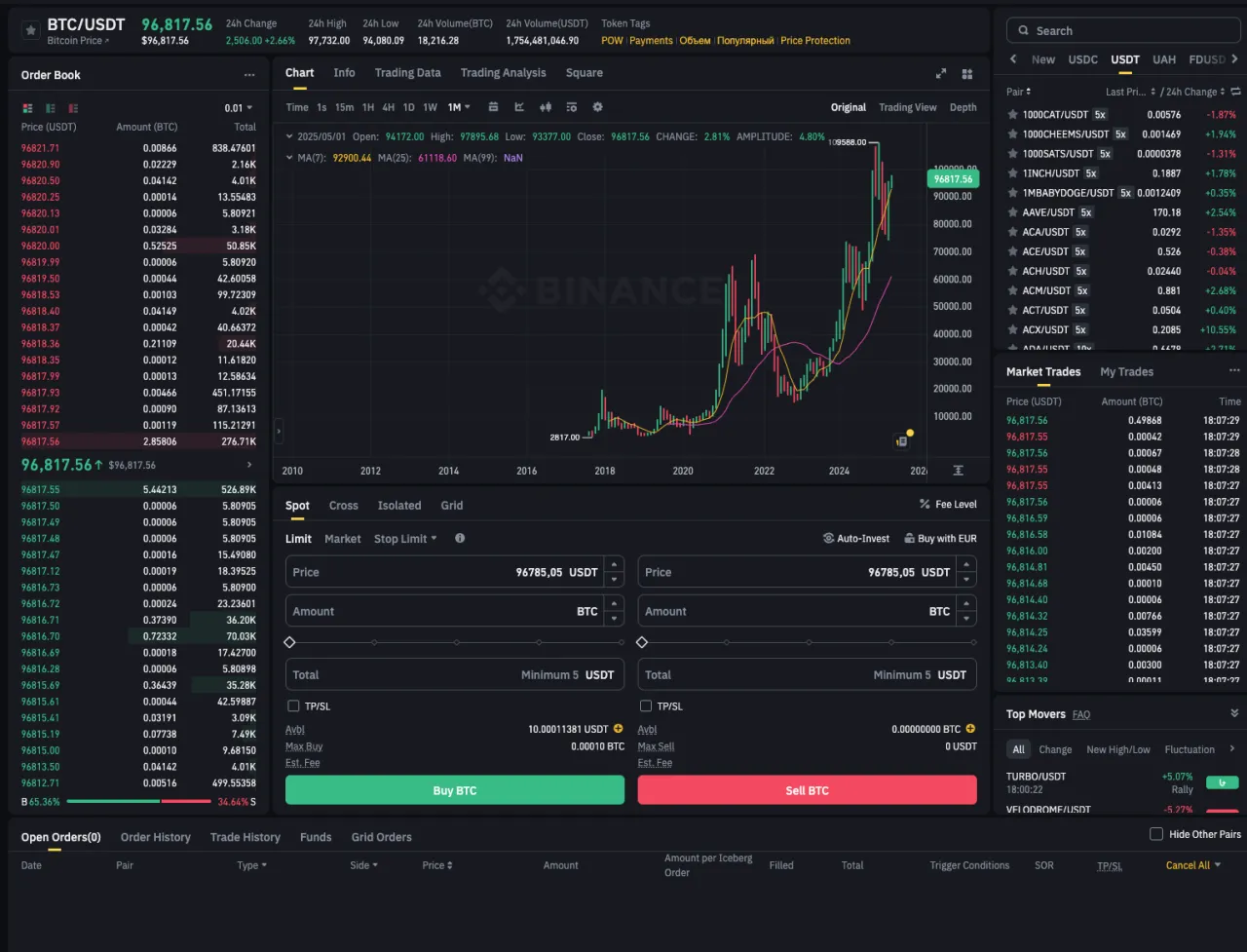

Step 4: Cryptocurrency trading

Depending on your goals, you can trade on the spot market or the futures market. Simply put, spot trading involves buying and actually owning the asset (usually chosen for long-term holding), while futures trading is more speculative and does not involve actual ownership of assets (but allows for higher profit potential due to leverage, along with higher risk).

If you’re new to crypto, we strongly recommend that you study the token in detail before making a spot market purchase, and fully understand the nuances of futures trading to avoid losing your savings.

Step 5: Explore additional features and capabilities

Crypto exchanges are not just for trading. Explore all the tools and features that the exchange offers, such as lending, earning, storing cryptocurrency in Web3 wallets, NFTs, and much more.

Basic features of Binance

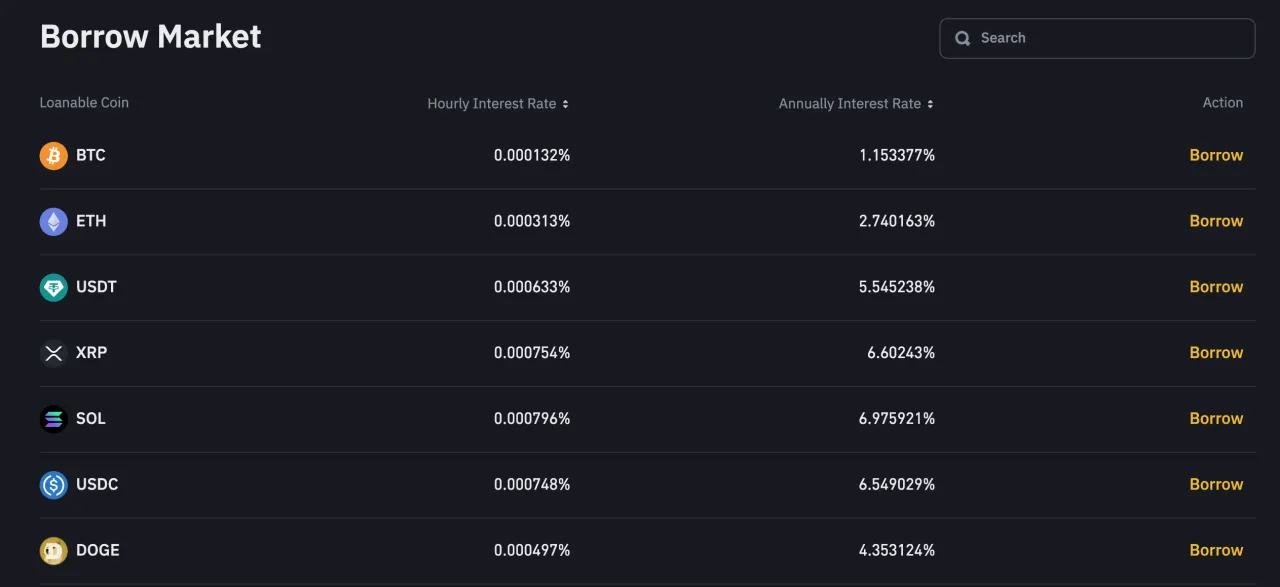

Loans

You can read about how cryptocurrency loans work here.

On Binance, you can find several types of loans, namely:

-

Loan with flexible terms (interest accrues daily and may fluctuate slightly; you can repay it whenever it suits you).

-

VIP loans (best terms for large loan amounts).

-

Fixed rate loan (you take a loan at a fixed rate for a certain number of days; it must be repaid by or before the last day, otherwise penalties may be applied and your position could be liquidated).

Are there risks? Yes, there are. If the collateral asset starts losing value, your position may be liquidated, and you won’t be able to recover your collateral, although the borrowed asset will remain with you.

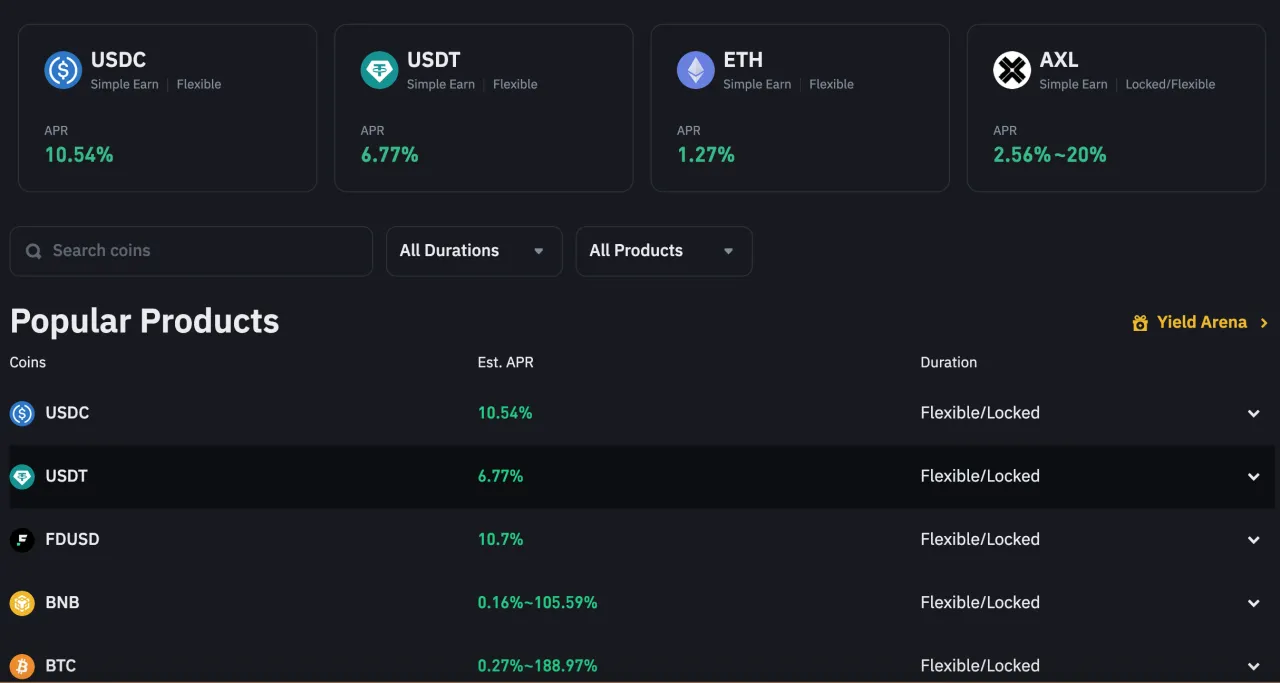

Earn

There are different ways to earn on Binance, all of which vary in risk and return rates. The higher the return, the greater the risk, so always research the best options.

In fact, there are 4 types of earning options:

-

Simple Earn. This is essentially staking within the Binance platform.

-

Dual Investment. This is a high-yield structured financial product that gives you the opportunity to buy or sell a digital asset at a price you specify and at a time you choose.

-

Smart Arbitrage. Arbitrage involves taking long positions in one market (e.g., spot) and short positions in another market (e.g., futures) in order to earn funding fees.

-

On-chain Yields. Allows you to easily participate in various blockchain (Web3) protocols directly from your Binance account.

Note: Earning types 2, 3, and 4 involve risks — you should study them in more detail before using any of these options.

Trading bots

Cryptocurrency trading bots are automated programs that help you buy, sell, and trade cryptocurrency. On Binance, you can create your own bot or use the marketplace to copy the settings of an already functioning trading bot.

The following trading bot strategies are available on Binance:

-

Spot Grid. Buy low and sell high 24/7 automatically with just one click.

-

Futures Grid. Amplify your purchasing power with an advanced version.

-

Arbitrage Bot. A delta-neutral strategy to earn funding fees effortlessly.

-

Rebalancing Bot. A long-term position strategy supporting an investment portfolio.

-

Algo Order. Enhance the execution of large orders by splitting them into smaller blocks using intelligent algo orders. Also available via API.

-

Futures TWAP. Slice large orders into smaller ones to achieve a better execution price. Available via API trading.

-

Futures VP. Split large orders based on a specific market volume ratio.

-

Spot DCA. Automatically place buy/sell orders for a better average price and close your position favorably.

In the Binance interface, everything is divided into categories, with filters, sorting, and settings. Everything is designed in the best traditions of Binance: simple, clear, and convenient enough for even a beginner to understand.

However, don't forget that like any type of trading, whether manual or using trading bots, there are always risks. Keep this in mind when setting up or copying a trading bot.

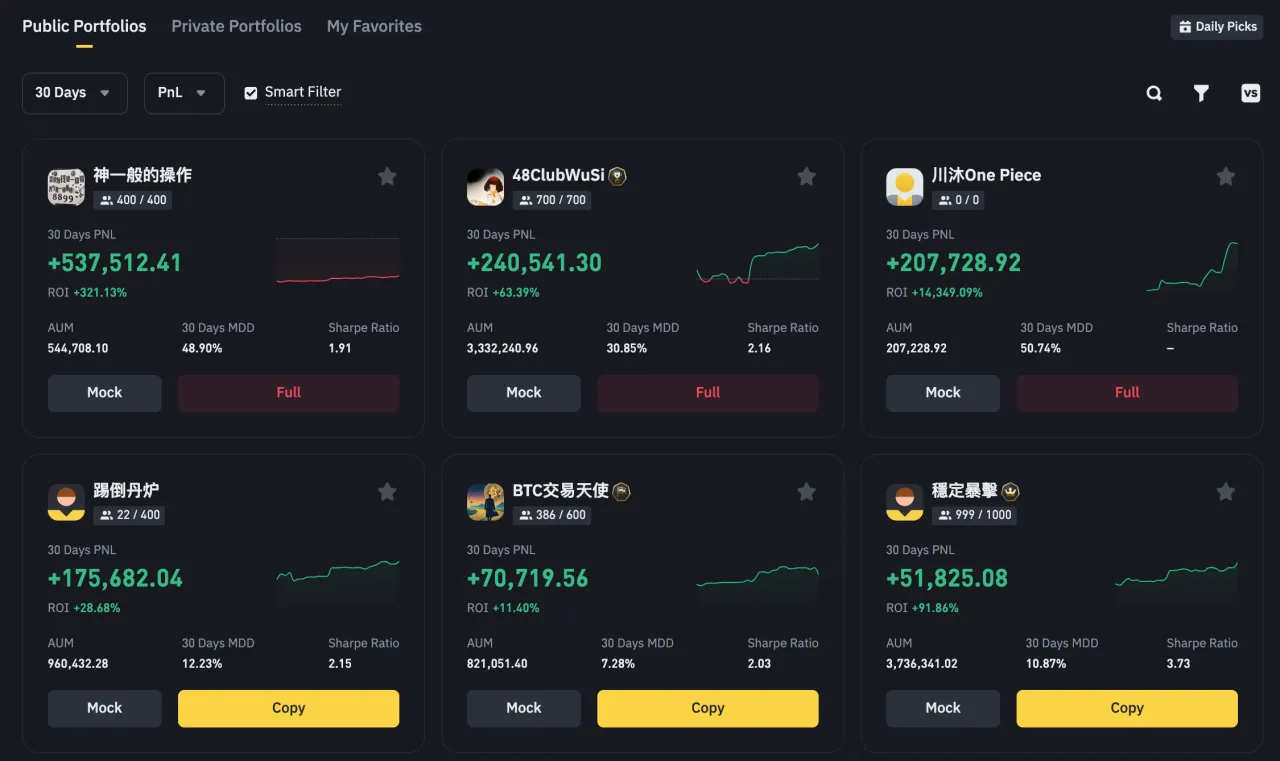

Copy trading

Copy trading means that the Binance system automatically opens the same trades as those made by the trader you choose to follow.

You simply select a trader, make a deposit, and your account begins to mirror their trades. These trades will close either when the trader closes them or when you decide to close them manually.

It may seem appealing, especially when looking at the performance charts of successful traders, but you should be aware of the risks and keep several points in mind:

-

Check how long the trader's portfolio has been active. If it's only been around for, say, 30 days, that's a sign the performance might not be consistent or reliable yet.

-

If it's futures copy trading, look at the leverage being used. The higher the leverage, the higher the risk.

-

Review how much of their own money the trader is using. The more personal funds at stake, the more trustworthy their strategy may be.

-

Remember that small investment amounts might not be profitable due to Binance fees. A trader may earn from high-volume investments, but if your capital is small, any profit could be eaten up by commissions.

Also, if you're an experienced trader yourself, you can publish your own portfolio and earn additional income from followers.

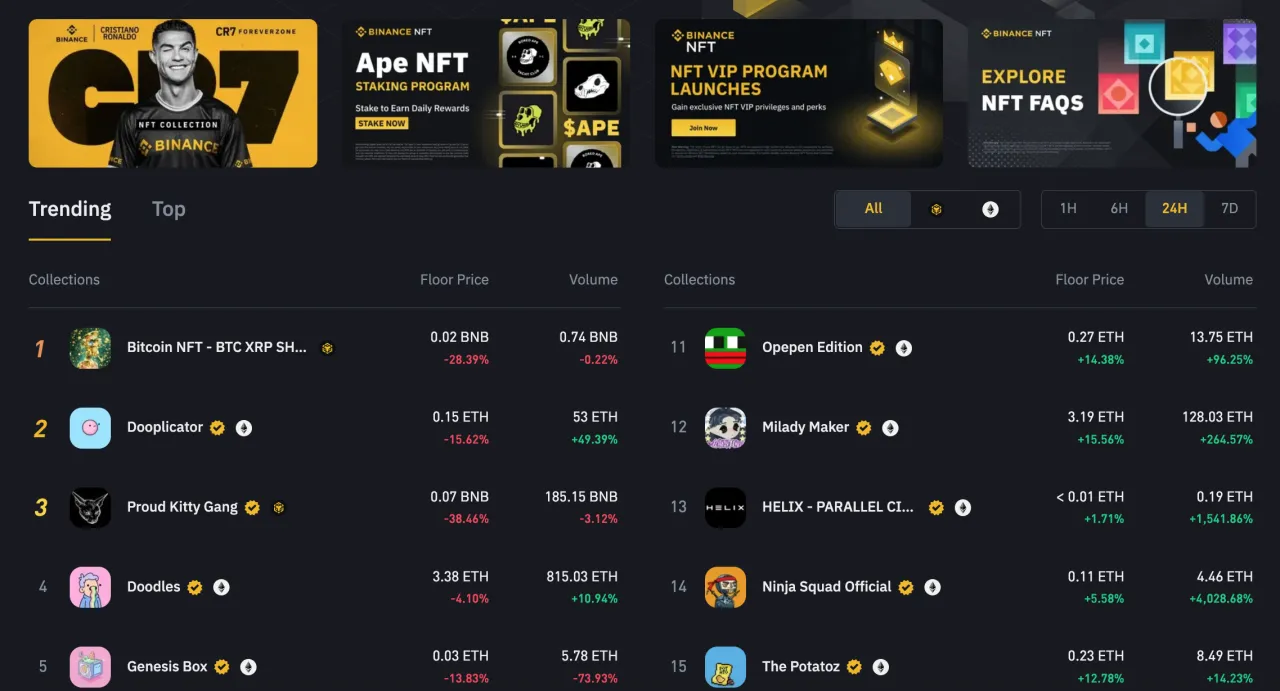

NFT

Binance has its own NFT platform. Buy and sell NFTs easily and securely.

API

With the API, you can interact with the Binance exchange through your own systems or integrate it with other tools such as analytics platforms, trading bots, and more. The API is an essential feature of every exchange, designed to make your interaction with the platform as efficient and seamless as possible.

Proof of reserves (PoR)

Another important feature of Binance is its proof of reserves. This means the exchange holds a sufficient amount of its users’ tokens and guarantees that, if something happens to Binance, you will be able to get your funds back. This became especially relevant after the collapse of FTX, when it turned out they had used users’ funds for their own purposes instead of keeping them in secure accounts, and were therefore unable to return them in full.

If you have experience using the Binance crypto exchange, leave a review — it will help other users make the right choice!

open the site Binance

Anonymous

2024-11-055 out of 5A reliable exchange, verification is quick and convenient, the interface is user-friendly, many features. Everything you need is on Binance; I consider it a top exchange.

ReplyThe original language is different from your language. The text has been translated automatically.